SIMPLE. EASY. EFFICIENT.

The BIG Point of Sale™ offers a highly configurable, easy to install point of sale solution. Our simplified consumer workflows and web-based portals allow for consumers and loan originators to collaborate with the back-office team to keep everyone informed throughout the loan process.

Low-Cost Adoption

All BIG POS contracts have $0 implementation cost and pay as you close pricing. Our average implementation time is under 2 hours for a full system integration.

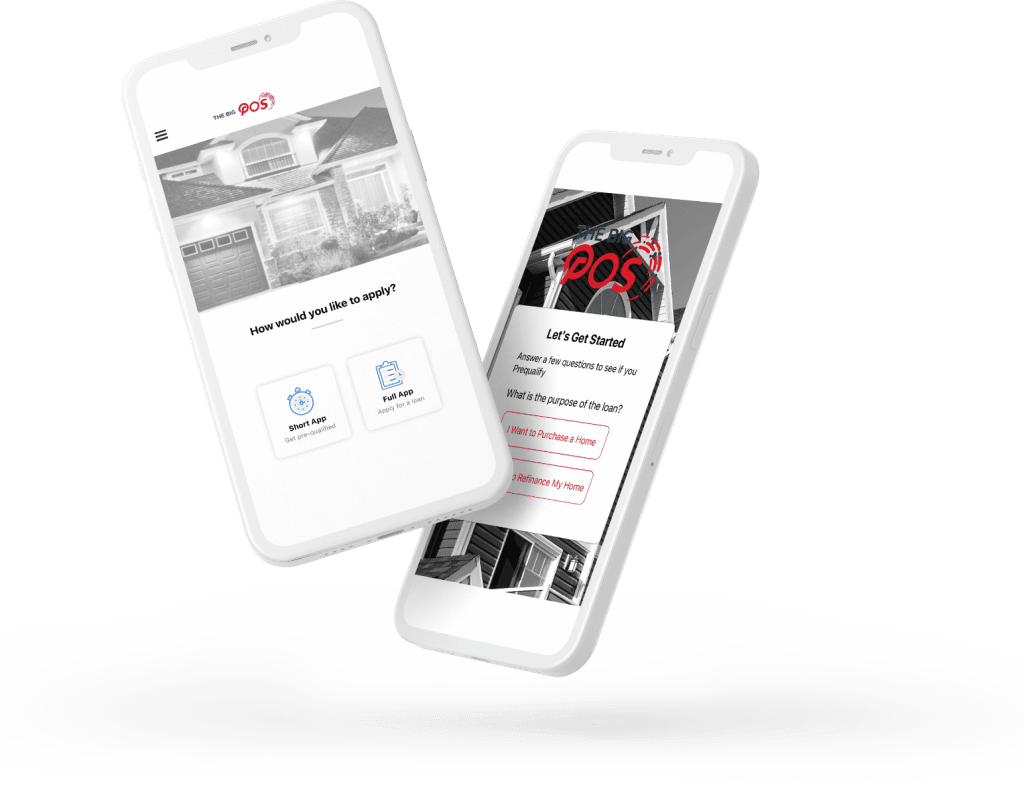

Loan Officer Mobility

Loan Officers can manage their pipeline remotely. Receive applications, quickly run pricing, and generate pre-approvals directly from the originators phone.

Provide a low-cost adoptable solution with a highly configurable interface.

We set out to build a Point-of-Sale system every lender knew they wanted but couldn’t find. Built by the people that use it every day The BIG Point of Sale was designed with the consumer in mind and the mortgage professional at heart. Fun flexible and easy to use, The BIG Point of Sale delivers efficiency and simplified workflows to your sales force and customer base.

Pricing Packages

Our pricing packages are designed with the independent mortgage banker and market conditions in mind. We understand the commitments that come with financial technology contracts. Our pricing is simple… no complex tiered pricing, no long-term contract, no minimum users, no minimum loans, with pay-as-you-go performance-based loan level pricing. In combination with our 2-hour fast track implementation you can try our solution for no cost before making any long-term commitments. Simply click GET STARTED and our on-boarding team will have you ready to implement within 72 hours.

The Little CRM

More information coming soon!

The Big Point of Sale

Per Closed Loan Pricing

Pay Per Closed Loan

No Minimum Closings

Loan Officer / Branch / Company Landing Pages

Consumer Portal

Task Based Rules Engine

Bi-directional LOS Integration

Document Manager

Loan Officer Portal

Mobile Pre-Approvals

Notification Manager

Custom Loan Application Workflow Editor

Real Estate Agent Portal

DBA Branding Options

Encompass Web Partner Connect Integration

FormFree Income / Asset Integration*

(*additional vendor fees may apply)

The BIG Agent

Pay Per Lead Generated

Works Seamlessly with BIG POS

Web Based Agent Portal

Unlimited Indvidual Broker Offices

Unlimited Agent Seats

Loan Officer Transaction Portal

Self-Managed Real Estate Partner Portals

Easy Sponsored Agent On-Boarding

TCPA Opt-in’s

System Lead Notifications – E mail

View all, Open House Check-in’s, Buyer & Seller Consultations & Listing Offers

Fully Compatible with all MAT Kiosk Hardware

(*To use The Big Agent lead generation system there is an annual system access fee of $2,000 per month or $20,000 paid annually)

Implementation Fee

There is no implementation fee associated with any of the Account Subscription Services. However, there is a Retainer in the amount of $10,000 that is due on the signing date of the Order Form. The Retainer is non-refundable and is considered a pre-payment for services that can be applied to any of the Account Subscription Services detailed above, including any customization work requested by the Customer.

Simple. Easy to Use Consumer Application.

The BIG Point of Sale consumer application workflows ask consumers one key question at a time. This methodology has proven to give the consumers the best possible application experience and keep them engaged throughout the web application. The average application is completed in under 10 minutes, reducing mid-application drop-rates.

Quick & Easy Setup

Our clients can begin processing applications through The BIG POS within 72 hours of completing the Get Started form. Once we process the Get Started Form, an implementation call is scheduled with the client’s loan origination system administrator which can take as little as 2 hours. In the time it takes to essentially demo a competitor point of sale system, the client can be in The BIG POS production environment testing applications at no charge and with no obligation. Our process eliminates months of implementation calls and development work. Simply click here to get started.

LoanPAD & KIOSK Options

Since Loan Originators can only be in one location at a time, our Kiosk offerings, distributed by our parent company Mortgage Automation Technologies, provide a line of exceptional hardware to be placed in Referral Partner offices. Place LoanPad at Open Houses or Kiosks in partner offices. Use them to collect leads or as direct access terminals to use all of the functionality of The Big Point of Sale

The Big POS Features

The BIG POS offers a dynamic POS to LOS integration. Our lender administration portal allows company admins to self-configure and adjust global and user based settings on demand. Set up multiple brands, configure new workflows and design custom HTML e-mail notifications. Your company admin will have full configuration control over the POS environment.

Questionnaire Based Workflow

Borrowers are presented with one question at a time to remove second guesses and guide a borrower through the application with speed and ease.

Workflow Editor

Have your own ideas? Need to design a custom workflow? Big POS allows for the creation of new landing pages paired with multiple workflows all customizable by the user.

Mobile Application

Subscribe to BIG POS Pro and we will launch a white labeled app to the Google Play Store and Apple App market. Due to its coding base, you are able to configure the mobile application directly from the admin portal.

Xactus Soft Pull Credit

Loan Officers can pull tri merge Xactus Soft Pull Credit reports directly from The BIG POS LO Web Portal resulting in reduced overall credit costs.

Halcyon Direct IRS Validation

Ask your borrowers dynamic questions and set tasks via the custom business rules engine. The BIG POS allows for Signature, Document Upload & Processor Ad HOC task sets.

FormFree Income & Asset Collection

FormFree Day One Certainty Income & Asset tasks allow for consumers to electronically sync Bank Statements and Income Documentation directly to the LOS Document manager.

Matthew VanFossen

Get Started Now